Content

The new accounting standard provides greater transparency but requires wide-ranging data gathering. Under FASB Statement no. 157, the highest and best use of all

assets, including real property, should be considered when measuring

that asset’s fair value. There are several factors to consider when preparing financial reports, and these will affect the amount of time it takes to create them. Investment property may include investment property that is being redeveloped. We undertake various activities to support the consistent application of IFRS Standards, which includes implementation support for recently issued Standards. We do this because the quality of implementation and application of the Standards affects the benefits that investors receive from having a single set of global standards.

This position will also be involved with ad-hoc finance and accounting related projects. Real estate accounting requires careful consideration and attention to detail. It is essential to maintain accurate records to ensure compliance with the law and better serve the interests of all parties involved in a property transaction. These reports give you deep insights into how your real estate business is performing, and where you can invest in your business to improve your bottom-line performance. After some time, you finally discover the source of the data, but now you have to go back and rework your reports and rerun them. Imagine if this happened more than a couple of times over multiple areas such as invoice numbers, rents, leases, cash payments, maintenance, insurance, and filings.

Property for sale in Turkey

Accounting is analyzing, recording, and reporting financial information for a business. This includes the creation of budgets, studying financial trends, and evaluating strategies for increasing profits or reducing expenses. The real estate industry has the support of some experts who work in it.

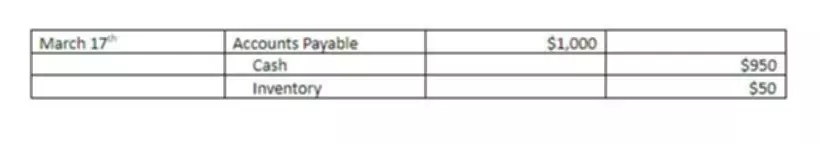

However, good real estate accounting software can help in the accurate evaluation of assets. However, for financials prepared using the income tax basis of accounting, rent income recognized in Year 1 of the lease would still be $900,000, assuming that Internal Revenue Code (“IRC”) Section 467 provisions do not apply. In this example, we again see that using tax basis accounting real estate accounting mirrors the cash flows to be generated from the lease, whereas GAAP produces “phantom income” of $300,000 ($1,200,000–$900,000) in Year 1 of the lease. In Year 6 of the lease, GAAP rent income would remain at $1,200,000 whereas tax basis rent income would be $1,260,000 ($105,000 per mo billed × 12 mos.). In addition, a company can use both GAAP and income tax basis financials.

Separate Personal and Business Funds

And to manage these growing transactions, accountants and bookkeepers are equally important in this industry. In addition, we must know the importance of bookkeeping and a chart of accounts for real estate agents. A chart of accounts for a real estate company represents all the accounts of your business gathered in one location. It gives you a birds-eye overview of every https://www.bookstime.com/ financial transaction of your company. The real estate chart of accounts will be different from other businesses because of the different nature of the business and distinct accounts. • Type B leases will be those considered operating leases under current accounting guidelines and will be account as rent expense on a straight-line basis over the term of the lease.

Using the right tool will save you time, money, and effort when it comes to your business’s financials. If you have multiple entities operating within your business structure, it will be helpful to create separate accounts for each entity to report all of the transactions that occur accurately. Organizing your records into a journal system can help make auditing easier and more efficient. For agents and brokers, real estate accounting allows them to gain better insight into their business’s health by having access to a full picture of their cash flow in one centralized system.

Supporting application materials

Finally, keeping close track of your income statement throughout the year can help you remain aware of how well your business‘ finances are performing. Still, if you take the time to understand the basic steps and create a solid foundation, it can have tremendous benefits for your business. Your business’s success depends on your business’s finances and creating a model that works for you. And if you have no idea where to start all this, OAK Business Consultant provides full-fledged support in all financial aspects of your business. Many real estate companies scan and submit each document to a safe, cloud-based backup system on the internet, though some investors preserve paper copies.

This will impact certain covenant calculations including debt-to-equity ratios. Using the income tax basis of accounting, no portion of the purchase price is allocated to in-place or above/below market leases. Accordingly, the real estate buyer would report real estate assets totaling $50,000,000 on its balance sheet, and there would be no reduction in rent income since there is no amortization of intangibles.

Investor Ready Document Services

FASB Statement no. 157, Fair Value Measurements, introduces

new concepts and practices to the world of financial reporting,

including some that are beginning to impact the fair value

measurements of real estate assets. Such concrete steps end up making a huge and positive impact on your business in the long run. Accounting remains an integral part of real estate, so; if you are looking forward to a successful real estate business, you have to take accounting seriously. Hiring an experienced offshore accounting agency offers you incredible benefits for your organization’s finances. While managing your company’s real estate accounting yourself to cut down on costs might sound tempting, it can be a hectic and risky job. The best way of outsourcing this task is by hiring an offshore accounting agency.

- Unfortunately, many real estate professionals fail to incorporate real estate accounting into the business hence suffering losses.

- Companies that prepare financial statements using GAAP must evaluate whether there has been impairment of their real estate, and if so, record an impairment charge in earnings.

- In addition to managing the money, the accountant must also be responsible for ensuring that the property is maintained in good condition.

- By hiring certified offshore accounting company services, you can focus on essential business operations while ensuring that your company’s finances are in safe hands.

- This list will save time when preparing taxes at the end of the year and provide you with quick access if ever audited by state authorities regarding compliance issues down the line.

- For instance, some tenants will pay rent due on January 1, 2010 in December 2009.

- However, a calendar year office REIT that invests in the same

building but reports the investment on the historical-cost basis had

been able to defer implementing Statement no. 157 for that asset until

Jan. 1, 2009.

This type of accounting method aligns with certain economic principles and is more accessible to investors. Real estate entities acquiring or constructing property for resale in the ordinary course of business (inventory property) shall account for such property in accordance with IAS 2. In accordance with this standard, the cost of inventories shall comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition. In this article, we will provide an example of a real estate chart of accounts that can serve as a starting point for investors looking to establish their own bookkeeping system.

Prepaid Rents

The other type of lease would be accounted in the Income Statement and Cash Flow Statement in a manner consistent with operating leases. The lease liability will be recognized as a lease liability based upon the present value of remaining lease payments and corresponding lease assets for operating leases. Now, all of these aren’t overnight tasks and need ample time and accuracy in numbers!

It covers all the areas like office amenities, property taxes, Insurance, and utility bills. Another aspect to consider when preparing financial reports for real estate is the cash flow. This summary serves to answer some questions relative to real estate entities reporting in accordance with IFRS and to better guide preparers of financial statements.

Learn Local Requirements

Bookkeeping and chart of accounts are prerequisites for financial planning. The relevant category and account help record the income or expense when a financial transaction occurs. An agile real estate bookkeeping system also enables the entry of transaction-specific information, making it simple to comprehend the purpose of each transaction. • Tenants may negotiate shorter term leases impacting landlords, no renewal options or contingent rents which could all affect a landlord’s cash flow. It recognizes both real estate commercial leases and mortgages as capital leases and required to be listed on the Balance Sheet.

Going through each and every transaction where you are spending money is highly prone to human error. Establish ESG policies and procedures in compliance with sustainability standards. Fair value should be measured from a market participant’s

perspective–what the property would likely sell for in that

asset’s principal or most advantageous market—and considering the

typical buyers for the asset. Before Statement no. 157, the allocation of the facility’s value may

have been approximately 20% to the land ($65,000 per acre times 3

acres) and the remaining 80% allocated to the building under an

„in use“ premise. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. We can help with a wide range of services across the full lifecycle of your fund.

That’s why CapActix emerges as the one-stop solution for your company’s finance and accounting needs. From bookkeeping to payroll management, our latest accounting solutions emerge as integrated software that will streamline your accounting work, providing you with more time to grow your business. As an investor, the only way by which you can maximize your income is by bringing down the expenses. Another way might include a close review of every work and transaction related to contractors or realtors, checking if it’s justified.

What does GAAP mean in real estate?

In financial reporting for real estate, Generally Accepted Accounting Principles (GAAP) and the income tax basis of accounting often yield very different financial reporting results. If the real estate entity is a publicly traded company, GAAP reporting is required.